Table of Contents:

As someone who enjoys researching different investment options, I've been fascinated by the emerging peer-to-peer lending industry in recent years. Rather than relying solely on traditional banks, this alternative model connects individual investors directly with borrowers seeking loans. In this article, I'd like to share an overview of how peer-to-peer lending works, its potential benefits and risks, and the keys to participating responsibly on either side of the arrangement.

I aim to provide a balanced perspective for readers exploring this innovative space. With any financial endeavor, knowledge equips empowered decision-making. So, without further ado, let's learn more about peer-to-peer lending.

How Peer-to-Peer Lending Works

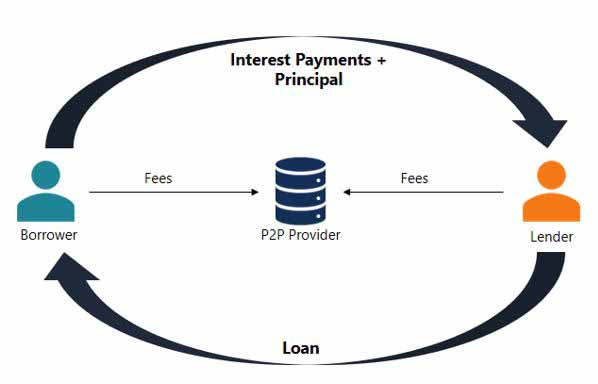

At its core, peer-to-peer lending involves three parties: investors, borrowers, and the platform facilitating connections between them. Individuals or businesses seeking loans apply online, typically indicating the amounts needed and their intended purposes. Applicants undergo credit checks and verification by the hosting company.

Once approved, loan requests appear on the platform, where individual investors can browse profiles and select those deemed most appealing and repayable based on criteria like credit ratings, industry experience, and other personalized details provided for assessment. Investors commit varying funds toward borrowers to pool into full loan amounts.

Successful applicants receive funds once their listings attract full investment backing. Both borrowers and investors must agree to terms set by the hosting site, which processes repayments, collecting principal plus interest that gets portioned out to lenders. Automated collection remedies exist if difficulties arise down the line, too.

Potential Benefits of Peer-to-Peer Lending

For Borrowers:

- Quicker loan decisions and funding vs traditional banks' red tape bureaucracy at times.

- Potentially lower interest rates via competition among investors.

- Building credit histories positively reporting timely payments to bureaus.

For Investors:

- Higher returns offered vs savings account payouts averaging a few percent annually.

- Diversifying low-risk by splitting savings across many borrower loans.

- Opportunities to directly impact others through affording credit for various needs.

For Both Sides:

- Transparent online platforms are removing offline branch intermediaries' overhead, passing interest savings.

- Direct interactions build understanding as real people rather than faceless institutions on either end.

Keys to Participating Responsibly

Of course, anyone borrowing or lending peer-to-peer warrants prudent research and risk management foremost:

- Diversify funds committed across multiple quality borrower profiles by credit score tier or industry whenever possible, risk mitigating significantly.

- Review platform performance history, loan default rates, and dispute resolution transparency, carefully prioritizing only top-rated, proven services.

- Beware promises of outsized returns pressuring hasty investments vulnerable to volatility and scams elsewhere, too, and stick to proven expected ranges.

- Set appropriate investment amounts per profile affordably carried minus pledged funds. Reinvest interest gains selectively over chasing unsustainable high-yield options.

- For borrowers, present clear purposes with full honesty to attract trustworthy backers competently; make timely payments sustaining credible relationships.

- Continually reassess factors like credit reports impacting underlying notes; pull funds proactively upon detecting troubles ahead, potentially curtailing losses.

With care balanced by potential, peer-to-peer lending merits consideration thoughtfully by both sides in control of related impacts and returns, respectively. Technology brings people together, financing lives and dreams collaboratively when guided well.

Keys to Evaluating Peer-to-Peer Lending Platforms

Given the choices, how then can one research and select reputable peer-to-peer lending sites instilling the greatest confidence? Here are some recommendations:

- Consider experience, originating the earliest platforms established track records of stability benefiting users longer term usually.

- Compare fee structures critically; reasonable charges must exist to sustain complex services, yet aim for the most competitive rates, neither exploiting borrowers nor investors.

- Thoroughly examine loan performance results published; prudent underwriting engines produce healthily low default percentages bearing trustworthiness over time.

- Scrutinize robust collections assistance available through downturns, too, shunning sites punting troubled cases elsewhere irresponsibly at users' expenses eventually.

- Verify regulatory involvement meets industry solvency and reporting standards, protecting participants from legal pitfalls and circumventing financial watchdogs altogether.

- Browse reviews from reputable sources objectively; positive user feedback resounding clearest confidence instills among peers transacting safely together ultimately.

With conscientious inspecting paired with balanced expectation management accordingly, wisely navigating the promising peer-to-peer lending sphere becomes fulfilling through its conveniences when guided well for all involved. Transparency travels both ways responsibly.

Growth Considerations Going Forward

As this fledgling financial model matures globally, certain aspects assure increasing focus:

- Artificial intelligence promises to improve automated underwriting, which is still imperfect; supervision mastering big data thoughtfully benefits inclusiveness.

- Integration tying lending networks obviously benefits liquidity, yet privacy concerns arise; thoughtful governance defines balances wisely over draconian policies.

- Impact investment opportunities emerge, affording access, particularly vitalizing underserved communities neglected by institutions; ethics steer forces for good.

- Democratized financing thrives cooperatively through openness, yet bad behaviors threaten sustainable self-regulation; wisdom weeds risks while cultivating potentials community-mindedly.

- Legislative clarity from experiences gained establishes certainty without stifling enterprising spirits; judicious guardrails protect innovation, serving people most benefitting.

With diligence, patience, and humanity's spirit of shared progress guiding peer-to-peer lending's ongoing evolution, boundless opportunities arise, empowering individuals, businesses, and societies globally to reach their fullest potentials collaboratively through tomorrow's tools working for all today. Exciting times remain ahead, indeed!

Peer-to-peer lending:

- Loan terms typically range from 3-5 years for bigger loans, although some platforms offer terms as short as three months for smaller loans.

- The borrower's credit grade usually determines interest rates - higher credit means lower rates, often in the range of 6-25% annually.

- Most platforms allow borrowers to make prepayments without penalty if they pay the loan off early. This avoids future interest costs.

- Some peer-to-peer options focus on specific types of loans like real estate, business, auto, or personal financing.

- Larger sums like $35,000+ may be broken into pieces for multiple investors. A single investor often backs smaller loans.

- Investors can set their leverage levels depending on risk tolerance - borrowing more than deposited funds to loan out more overall.

- Peer-to-peer income can be taxed as either interest or business/self-employment income, depending on the level of trading activity.

Conclusion

In conclusion, while still a nascent industry, peer-to-peer lending has proven itself a viable alternative to traditional banking by connecting those who need funds directly with individual investors. As the space continues to mature, innovations in areas like AI-driven underwriting, specialized loan options, and growing integration promise even greater access and opportunities for participants globally.

Of course, as with any financial endeavor, both lenders and borrowers must proceed thoughtfully by diversifying risk, researching platforms thoroughly, and abiding by responsible lending practices. But when approached conscientiously, this emerging model has much potential to empower people everywhere through inclusive access to capital.

Overall, with diligence and guidance from experienced users, peer-to-peer lending presents benefits for borrowers seeking affordable rates and investors diversifying savings in a novel way. Looking ahead, ethical solutions envisioned to address challenges could yield incredible societal impacts, emancipating underserved communities neglected by institutions alone. With open-mindedness nurturing such promising technologies working for good, tomorrow brightens for all.

Frequently Asked Questions:

What is peer-to-peer lending?

- Understanding the concept of peer-to-peer lending is important for individuals interested in alternative borrowing and investing options. This guide will explain that peer-to-peer lending, also known as P2P lending, is a method of borrowing and lending money directly between individuals through online platforms. It will discuss how P2P lending eliminates the need for traditional financial institutions as intermediaries, allowing borrowers to access loans and investors to earn returns by lending funds to borrowers.

How does peer-to-peer lending work?

- Exploring the mechanics of peer-to-peer lending helps individuals grasp the process involved in borrowing and investing through P2P platforms. This guide will explain that borrowers create loan listings on P2P platforms, outlining the loan purpose, amount, and interest rate they are seeking. Investors then review these listings and fund the loans they find attractive, typically by contributing a portion of the loan amount. As borrowers repay the loans, investors receive principal and interest payments, providing them with a return on their investment.

What are the benefits of peer-to-peer lending for borrowers?

- Understanding the benefits of peer-to-peer lending for borrowers can help individuals assess if it is a suitable option for their financial needs. This guide will discuss advantages such as potentially lower interest rates compared to traditional lenders, faster and more streamlined application processes, flexible loan terms, and access to funds for individuals with limited credit history or lower credit scores. It will also highlight the potential for personalized loan options and the ability to consolidate debts.

What are the benefits of peer-to-peer lending for investors?

- Exploring the benefits of peer-to-peer lending for investors helps individuals evaluate the potential advantages of participating in P2P lending platforms. This guide will explain that investors can earn potentially higher returns compared to traditional savings accounts or other investment options. It will discuss the ability to diversify investment portfolios by lending to multiple borrowers, the transparency and control provided by choosing which loans to fund, and the potential for regular income through interest payments. It will also highlight the accessibility of P2P lending platforms for individuals looking to invest smaller amounts of money.

Are there risks associated with peer-to-peer lending?

- Recognizing the risks associated with peer-to-peer lending is important for individuals considering this alternative form of borrowing or investing. This guide will discuss potential risks, such as the possibility of borrowers defaulting on loans, which may result in partial or complete loss of invested funds for investors. It will also highlight the importance of conducting thorough due diligence on borrowers and understanding the potential impact of economic downturns or changes in interest rates on the performance of P2P loans. It will emphasize the need to carefully assess risk tolerance and diversify investments to mitigate potential losses.

How do I get started with peer-to-peer lending?

- Knowing how to get started with peer-to-peer lending is essential for individuals interested in exploring this borrowing or investing option. This guide will provide an overview of the steps involved, such as researching and selecting reputable P2P lending platforms, creating an account, completing the necessary verification processes, and familiarizing oneself with the platform's loan listings and investment options. It will also recommend starting with smaller investments or loan amounts to gain experience and assess the performance of the P2P lending platform.

Related Topics: Loans

Related Articles:

- The Dos and Don'ts of Loan Applications

- Managing Student Loans: Tips for Graduates

- How Interest Rates Affect Loan Repayment

- Tips for Negotiating Better Loan Terms